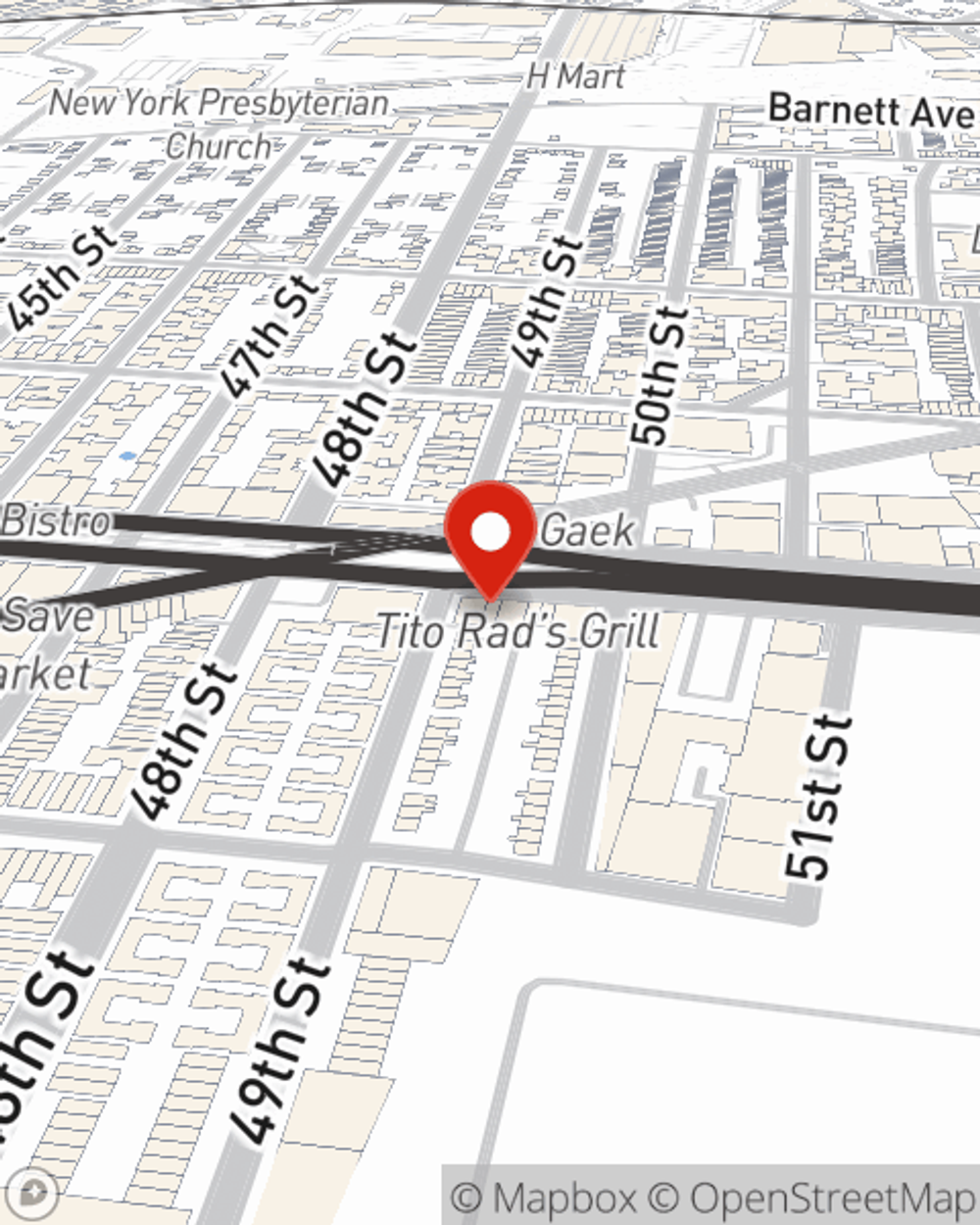

Renters Insurance in and around Woodside

Woodside renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Queens

- Bronx County

- Hudson County

- Queens County

- New York County

- Kings County

- Sunnyside

- Corona

- Jamaica

- Maspeth

- Flushing

- Glendale

- Woodside

- Ridgewood

- Woodhaven

- College Point

- East Elmhurst

- Middle Village

- Jackson Heights

- Forest Hills

- New York City

- Brooklyn

- Bronx

- Astoria

Home Sweet Home Starts With State Farm

It may feel like a lot to think through your busy schedule, work, your sand volleyball league, as well as savings options and coverage options for renters insurance. State Farm offers no-nonsense assistance and remarkable coverage for your swing sets, clothing and furniture in your rented apartment. When trouble knocks on your door, State Farm can help.

Woodside renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

State Farm Has Options For Your Renters Insurance Needs

Renters insurance may seem like the last thing on your mind, and you're wondering if it can actually help protect your belongings. But imagine what it would cost to replace all the personal property in your rented property. State Farm's Renters insurance can help when fires or break-ins damage your possessions.

State Farm is a reliable provider of renters insurance in your neighborhood, Woodside. Call or email agent Kenny Vega today and see how you can save!

Have More Questions About Renters Insurance?

Call Kenny at (718) 413-0033 or visit our FAQ page.

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.